CSPR – Utility (not security)

The CSPR token provides utility – it is used to pay for gas fees on the Casper blockchain. CSPR owners and validators can also stake their tokens on the protocol to contribute to the network’s security in exchange for inflation rewards. This demand for gas will be the primary driver of appreciation of the CSPR token. Being a utility, we can therefore assess CSPR demand in a similar way to how we would assess demand for semiconductors in general terms or more specifically commodities such as copper.

Security vs Utility

Within the crypto space, coins/tokens are split into two primary categories:

- Security: Digital assets that derive their value from an external asset that can be traded. Within the US, these are subject to federal laws. These are either (we have assigned more traditional asset classes to each as examples):

- Participations in real physical underlying’s (like some Derivatives)

- Earning streams (Equity)

- Exposure to companies (Equity / Derivatives / Bonds)

- Entitlement to interest payments or dividends (Equities / Bonds)

- Utility: Digital coupon that can be redeemed in the future for discounted fees or special access to a product or service. These are not used as investments and are therefore exempt from federal laws.

The Howey Test is used to help assess if an asset is a security:

“A contract, transaction or scheme whereby a person invests his money in a common enterprise and is led to expect profits solely from the efforts of the promoter or a third party, [is a security under the US Securities Act]”

An interesting thought on the above is the change in stance of the SEC in the US with regard to ETH. In 2018, William Hinman, then Director of the SEC’s Division of Corporation Finance, implied that Ether was initially offered through a securities offering but was no longer a security at the time. The reason for this was that as blockchain became increasingly more decentralized there was no longer any central enterprise being invested in, and thus purchasers no longer reasonably expect a person or group to carry out essential managerial or entrepreneurial efforts. Therefore assets can transition out of security state through sufficient decentralization.

The Semiconductor and Copper Comparison

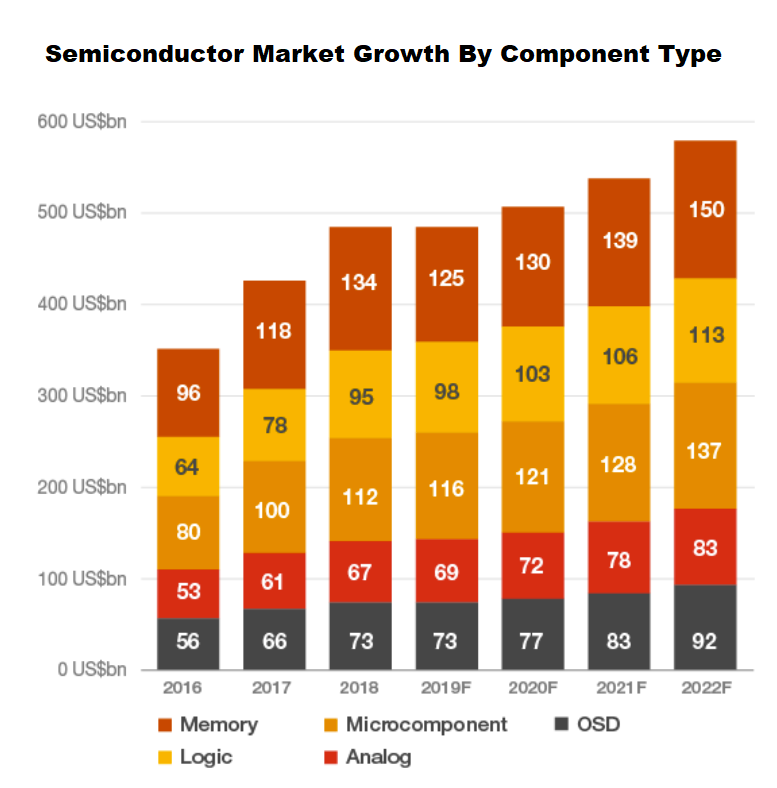

Copper demand has traditionally been used to forecast macro trends, due to its requirement for multi purpose wiring. However, in recent years, we can now also introduce semiconductors as a proxy to the macro growth rates, inferred from the growth in technologies. We shall look at the semiconductor sector and copper as a commodity to try to make comparisons with future CSPR demand.

- Growth in digital tech generally is what is driving the demand for semiconductors, with more recently AI technologies further boosting demand.

- Historical growth in copper has been driven by general electrical systems and wiring however recent demand is boosted by growing industry sectors such as semiconductor wiring and electrical battery technology.

The above is taken as a snap of only the most recent 6 year period – this is already after monuments demand for semiconductors over the last 2 decades. This shows how non transient technologies will continue to grow in demand. So how can we use the above to help us understand the potential growth in demand for the CSPR token? We have seen how the rise of the internet has dominated the last 20 years and have also analysed the dynamics of the dotcom bubble here. We have also used the analogy of successful tech stocks, but what is more relevant is assessing how structural macro shifts (i.e. new technology adoption) in market places contribute to increased demand in certain assets. Just as the advert of the electric car market and growth in demand for computing power is driving the demand for copper and semiconductors, the growth of blockchain technologies and their adoption will be what drives the value of gas on these blockchains. We can therefore proxy CSPR growth in a similar fashion to that used historically for semiconductors if we assert that (1) blockchain technologies are here to stay and that (2) CSPR blockchain will hold a sizable share of the future market. We have argued across many articles on our site how both of these are indeed true…therefore we can surmise that the CSPR token has potential for substantial growth in demand, and therefore value.

Disclaimer: This article is written for the purposes of research and does not constitute financial advice or a recommendation to buy.

Stake your CSPR with us at GHOST:

1. Earn passive interest compounded every 2 hours!

2. High performance server with low CPU utilization that can be monitored in real time here

3. Low fees with a GUARANTEE of no increases EVER!

find out more here

2 thoughts on “CSPR – Utility (not security)”

Comments are closed.

Attractive element of content. I just stumbled upon your weblog and in accession capital to claim that I acquire in fact loved account your blog posts. Anyway I抣l be subscribing to your feeds and even I success you get right of entry to consistently rapidly.

Thank you very much for you kind words. If there is anything specific you would like us to create commentary on, please do let us know.