Casper vs Cardano

As Cardano is ranked #4 in terms of market capitalization (~$70bn), by far the largest PoS network, we shall try to understand the reason for this valuation. We shall be inspecting both the protocol and adoption strategy and conclude why we believe Casper is stronger both in terms of longer term fundamentals, but also short term relative value.

As we have extensively covered CSPR in our previous articles, we shall focus on first providing insights into Cardano and the Ouroboros consensus protocol before moving to the comparison and concluding with a summary. We recommend first reading our deep-dive of the CSPR token here.

I will show how Cardano’s aggressive ‘vertical strategy’, pushes the community to flood social media with Cardano marketing and content, with the specific goal of increasing active wallets and how this strategy is likely inflating the price above its true value. We shall also discuss how the pace of development on the Cardano network is lagging behind a lot of newer layer 1 chains and how with an expected rapid advancement in blockchain innovation, this poses significant risks to the Cardano blockchain.

Background

Cardano was launched in 2017 and spearheaded by Ether co-founder Charles Hoskinson. The platform began development in 2015 after a dispute between Hoskinson and Vitalik Buterin regarding the accepting of venture capital funds. Hoskinson was in favour of accepting funds to create a for-profit profit entity, whereas Buterin favoured the non-profit approach.

The token presale occurred in Asia from September 2015 to January 2017, raising $62 million. A total of 26 billion tokens were sold at US $0.0024 each. Public trading of the tokens began on October 1st, 2017.

The three entities supporting Cardano’s development received 5.2 billion ADA following the mining of Cardano’s genesis block. Their allocation was as follows:

- 2.46 billion ADA were allocated to IOHK and are held under the following vesting strategy:

- ⅓ IOHK’s ADA holdings were immediately available to IOHK.

- ⅓ was made available on June 1st, 2018.

- ⅓ was made available on June 1st, 2019

- 2.07 billion ADA were allocated to EMURGO, a developer company

- 0.648 billion ADA were allocated to the Cardano Foundation

Protocol Roadmap

The Cardano consensus protocol is based around Ouroboros.

Ouroboros is a proof of stake blockchain that was first proposed by Aggelos Kiayias in the annual international cryptology conference in 2017. There are many implementations of Ouroboros, which shall be detailed below. The evolution of Cardano is based upon these various implementations whereby each new implementation is a step further towards Cardanos end goal.

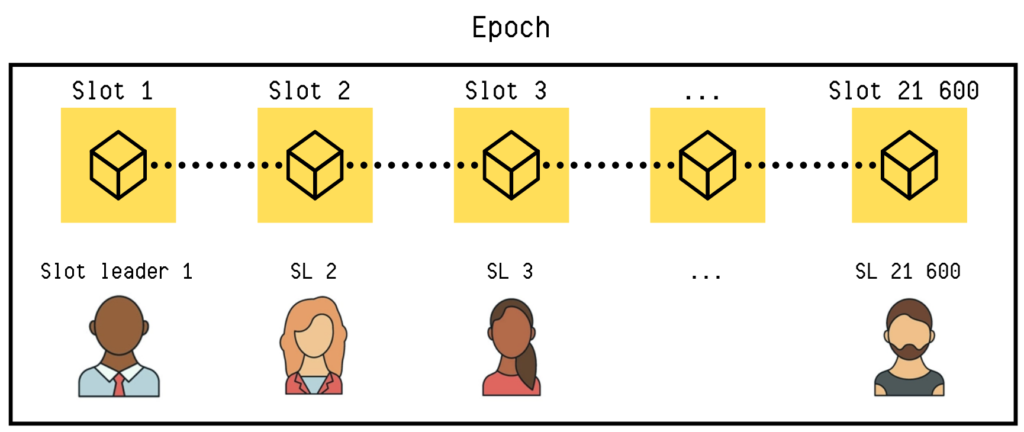

The USP of Ouroboros is the use of a randomized process to elect a new ‘slot leader’ to produce each block, based on the amount of staked tokens.

- Classic – Initially used on the Cardano mainnet, the classic implementation laid the foundations for a Proof-Of-Stake protocol which has the ability to generate unbiased randomness in the protocol’s leader selection algorithm. Its claimed that this randomness prevents the formation of patterns which is the key part in maintaining security: as whenever behaviour can be predicted, it can then be exploited. The random nature in question is with the selection of a ‘sot leader’ who is responsible for appending the ‘next’ block onto the chain and then passing the chain on to the next randomly selected slot leader. Note, each new slot leader is also required to consider the last few blocks of the chain as transient, before appending the next block. Only the chain that precedes the prespecified number of transient blocks is considered settled. This is also referred to as the settlement delay.

- BFT – (Feb 2020) Used by Cardano during the Byron era (the transition period between the old Cardano to the new ‘Shelly’ era which uses Praos – detailed below). Ouroboros BFT is an extremely simple Byzantine Fault Tolerance (BFT) protocol that follows from the Ouroboros Classic. Rather than requiring nodes to be online all of the time, Ouroboros BFT assumes a federated network of servers – i.e. the protocol only allowed three entities to produce blocks: IOHK, Emurgo and the Cardano Foundation. During this period, stake delegation was not possible and therefore the production of blocks did not generate any rewards. It provides the ledger consensus properties of consistency and liveness assuming a number of Byzantine corruptions t < n/3.

- Byzantine Fault Tolerance (BFT) is the ability to tolerate participants that arbitrarily deviate from the specification of the protocol, even when these deviations may be orchestrated by an adversarial entity.

- Praos – This was the next evolution (Shelley era of Cardano) and is based upon Ouroboros Classic but with security and scalability improvements. The Shelley era began on epoch 208 with the Shelley Hard Fork. This protocol enables stake delegation and stake pools (defined below). In this update, the network moved from centralized (i.e. only the 3 entities above producing blocks), to decentralized, where the community is able to validate transactions (as with other PoS networks). Participants are prevented from exerting too much control over the Cardano network through a pool saturation point, at which point the pool would realize diminishing returns for participating in consensus. This is to prevent a handful of pools having a disproportional probability of being chosen as a slot leader.

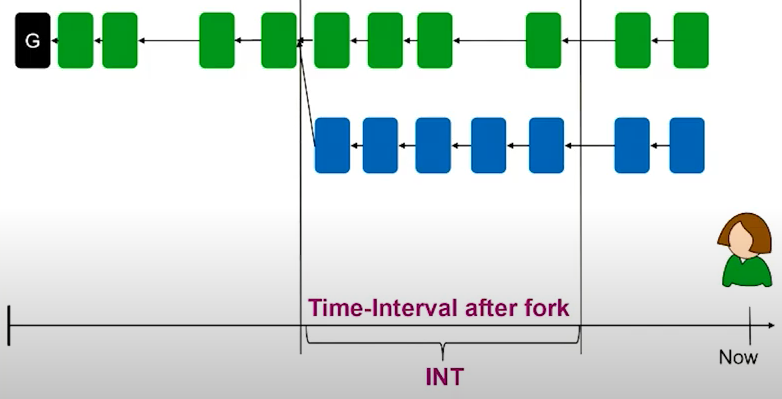

- Genesis – Improves upon Ouroboros Praos by adding a ‘chain selection rule‘, which enables parties (validators) to bootstrap from a genesis block, without the need for trusted ‘checkpoints’ or assumptions about past availability – know as ‘Dynamic Availability‘ (read more about dynamic availability in our article here). When a new node joins the network, if there is ambiguity on which chain is the correct chain (due to forks), for Bitcoin you can simply join the longest chain. For other general PoS blockchains, its a little more complex and ‘checkpoints’ are implement along the chain which are considered trusted markers (trusted block) denoting the chain (from the genesis block to that trusted block) is correct. The issue with checkpoints however is that for a new node joining the network, they will be unaware of the checkpoints and therefore will need a trusted 3rd party to flag these. The specific chain selection rule for Ouroboro Gensis, which does not need a trusted block, is simply:

- For a fork smaller than a predefined amount of block (i.e. recent fork where the number of blocks since the fork until the latest block is small) – use the longest chain rule

- For a fork larger than a defined amount of blocks – use the ‘plenitude’ rule:

- Plenitude rule – This is simply to split the chain into time slots from the point of the fork and then select the chain which is denser (i.e. has more blocks). The intuition is that if enough honest parities follow this rule, then at any sufficiently long time segment, the corresponding chain will be more dense. This eradicates the need to have a trusted recent block for dynamic allocation. In the below illustration, you will note that with the new chain selection rule, the blue chain will be chosen (whereas previously under ‘Praos’, the green chain would have been selected).

- Hydra – which will be an off-chain scalability architecture (layer 2 implementation), addresses three key challenges: (1) high transaction throughput (2) low latency (3) minimal storage per node. In addition, this solution would also make it possible to complete micropayments, voting systems and support insurance contracts.

- The increased throughput is achieved by using a ‘multiple lanes’ approach for data transactions per users: each user creates 10 ‘heads’, whereby each head is considered a lane that can process 1000 transactions per second. This would mean in theory, with a 1,000 ‘heads’ the network could be capable of processing 1m transactions per second.

Protocol Detailed

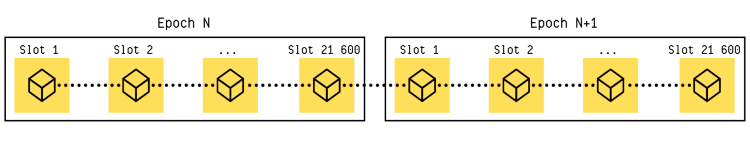

Chains are divided into blocks of time called epoch’s and individual units of time within an epoch are slots.

For each slot, a stake pool is assigned as the slot leader, and is rewarded for adding a block to the chain. For security reasons, there is mechanism in place called ‘settlement delay’ where a slot leader before appending a block to the chain is first required to consider the last few blocks of the received chain as transient and only the chain which precedes a prespecified number of transient blocks is considered settled. This is the mechanism the ledger is securely passed between participants (slot leaders).

As not all stakeholders will have the expertise to produce a block if elected, they are able to pool their resources by delegating their stake to stake pools. The managers of the pool (pool operators) manage block production if elected as slot leaders. Note, these can be considered in a similar way to mining pools in Bitcoin, discussed here.

The slot leader is chosen using a randomness generation process ‘publicly verifiable secret sharing (PVSS)’.

PVSS: In this scheme, a ‘secret’ is split up into many shares and the original secret can only be reconstructed if a single party has access to a certain portion of the shares (eg >50%).

ghoststaking

The PVSS scheme developed for Cardano is called SCRAPE.

- SCRAPE: A relatively simple coin flipping type game is used where party A flips the coin and party B calls either heads or tails. However in this game, if the caller is not based in the same location as the flipper, there could be reasons for ambiguity and mistrusts. For example Alice calls before Bob flips, could mean that Bob can state an incorrect result in his favour after the flip. Similarly if Alice only discloses her call after Bob conveys the result of the flip then Alice can falsely skew the result in her favour. Therefore instead, a ‘commitment’ under a PVSS is shared by Alice, and verified by Bob after the coin flip:

- Alice “calls” the coin flip but only tells Bob a commitment to her call

- Bob flips the coin and reports the result

- Alice reveals what she committed to

- Bob verifies that Alice’s call matches her commitment

- If Alice’s revelation matches the coin result Bob reported, Alice wins

Protocol Example

The protocol runs like the following:

- Committee formation: The distinct slot leaders for the epoch form a notional committee that will play the coin flipping game. Each committee member privately generates a random number 𝒖 (their flip of the coin).

- Commit phase: In the first 2𝒌 slots of an epoch, committee members post their PVSS data for 𝒖 to the blockchain according to the particular PVSS scheme the protocol uses. Each party posts:

- A commitment to 𝒖.

- A “share” of 𝒖 for every other committee member encrypted with their public key. This share gives them no information about 𝒖 but if you have more than half of the shares you can reconstruct it.

- Cryptographic proof that the 𝒖 committed to and the one shared are the same.

- Reveal phase: In the next 2𝒌 slots, committee members reveal their 𝒖 on the blockchain.

- Recovery phase: In the last 1𝒌 slots, committee members check who hasn’t revealed their 𝒖. For every party who hasn’t revealed 𝒖, each member posts their share of that party’s 𝒖 to the blockchain. Once over half the shares are posted, all parties can reconstruct the 𝒖 for that party.

- New Epoch: The 𝒖 values from each party are now publicly known. They are xor’d together to get 𝞺 which is used as a seed to pick a random satoshi (the smallest currency unit) for each slot in the next epoch. The owner of that satoshi is the slot leader. The committee formation for the next epoch now begins.

Smart Contracts

Cardano has recently introduced smart contracts via its Alonzo update in September 2021 (epoc 290), thus officially markjing the start of the Goguen era. The smart contract update in Cardano will allow for the creation of dApps. During the first 24 hours post the update, Cardano saw more than 100 smart contracts processed.

The upgrade came after 6 years of research and development. Programmers for Cardano’s smart contracts will use one of three languages: Plutus, Marlowe or Glow. Plutus is “a purpose-built smart contract development and execution platform” that runs both on-chain and off-chain. Marlowe is Cardano’s domain-specific language (DSL) used moreso for financial contracts, while Glow is a DSL used for writing decentralised applications (dApps)

Adoption Strategy

Cardanos ‘vertical strategy‘ pushes the community into making “easy to watch, informative and entertaining” videos that range between 10 and 60 seconds that targets users on TikTok, Instagram reels and YouTube stories. There is a huge push to grow the network through community marketing and even strategic pushes to expand the content on social media platforms which are generally thought to be have younger demographics.

The reason for this very aggressive push is to utilize a the phenomenon the “network effect” (read more about the network effect here). A summary of this effect is: more users and more owners means more developers. That in turn means more projects, more use cases, and thus more users and more owners, and so on – i.e. accelerating the growth of the network through targeted, aggressive marketing

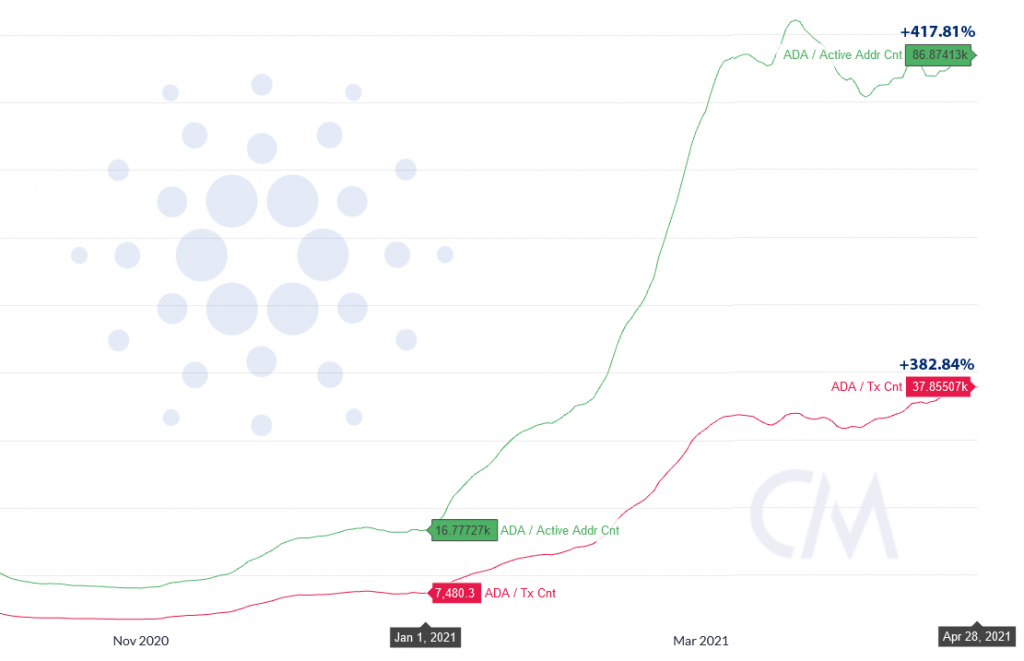

Cardano is reported as targeting as much as 1billion active wallets within the coming years and have focused not only on the vertical strategy in Western regions, but also a hard push to wallet adoption in region such as Africa. The chart below illustrate the growth in wallet for the first half of 2021.

Issues

Before moving onto a direct comparisons between Cardano and Casper, we would first like to highlight some specific issues we see with the Cardano project.

- There is still no single popular application deployed on the Cardano blockchain. This is due to the lengthy time taken to productionise smart contracts.

- Although Cardano is unique in the fact that it was the first project founded on peer reviewed research and development, the lengthy research phases which Cardano is going through means it is at severe risk of becoming outdated when compared to the rapid development within the blockchain space. In addition, with the reliance on evolving ouroboros, the projects seems heavily married to the consensus protocol and will likely see big issues in the future if a major change is required (as we are currently seeing with the efforts required to implement major changes to the Ethereum protocol). As a network grows substantially in size, implementing major changes to fundamental components becomes increasing more difficult, if the system is not designed as pluggable.

- ADA may be relatively “overvalued” compared to other smart contract blockchains as it is currently an unfinished product; while it boasts years of research and marketing, it is still in an early stage of development and much of its current value is based upon its aggressive marketing tactics to increase active wallet addresses.

- A lot of data is written to the blockchain in the commit phase. The number PVSS related messages is proportional to 𝒎² where 𝒎 is the size of the committee. Large committee sizes cause large communication and computational overheads. This necessitates a minimum stake limit for being a committee member to cap the size of the committee.

- As the slot leader schedule for the current epoc is public, an attacker can identify which parties it would be best to corrupt ahead of time.

- Although Cardano has been in existence for many years (longer than most other layer 1 chains), during the Byron era, the network was permissioned (federated and controlled by only IOHK, EMURGO, and the Cardano Foundation), meaning there was no decentralization and security was never put to the test.

- Cardano has multi layers: CSL (settlement layer), where value is transferred, and the CCL (computation layer), where computation takes place. This was to increase efficiency, scalability and capacity for soft fork protocol changes. The CCL deals with the “why” of the ADA transactions and is where smart contracts come into play, versus the CSL which handles the accounting of the movement of assets. The activities/reasons behind certain applications running on a blockchain may not be ones supported or endorsed by all in the network. This opens up the risk of potential censorship.

Comparison with CSPR

We shall now focus on drawing some comparisons of Cardano with CSPR

- Network nodes:

- Cardano requires a block producer to have a minimum of 4GB RAM (8GB for relay nodes).

- CSPR nodes are required to have 32 GB of RAM.

- A validator on Cardano currently holds between 0 and 63M ADA, 63M is the ‘sweetspot’ for optimal rewards, whereas for CSPR a new validator needs to merely hold more CSPR than the current 100th place validator. The huge cost in holding an optimal amount of ADA for a Cardano validator means that only large institutions will meet this criteria.

- Decentralization:

- Cardano has only very recently moved from a federated blockchain, where there were only 3 block producers, to allowing the community to produce blocks thus encouraging decentralization.

- The Casper maintain launch was only 6 month prior to the time of writing this article, however all 100 community validator slots have been taken and is exhibiting good levels of decentralization at this early stage.

- Throughput:

- Cardano operates at about 7 transactions per second. This however is parameterized and maybe adjusted up to approximately 50tps

- This compares with CSPR which is currently achieving 2.5k transactions per block (100 WASM deploys per block)

- Both protocols have promised increased TPS via a layer 2 solution

- Security:

- The security and finality of the CSPR network has been covered in these two articles: CBC and Highway. From the articles its clear that CSPR is a powerful non-statistical method to guarantee security and finality given a threshold of malicious nodes.

- For ADA security, participants are prevented from exerting too much control over the network via a pool saturation point, that exhibits diminishing returns when exceeded.

- Smart Contracts:

- Casper uses ‘Rust’ for smart contract development.

- Cardano uses Plutus, Marlowe or Glow.

- Bespoke languages will inherently contain more difficulty with the requirement for first learning the language. In addition with bespoke languages such Solidity, when compared to Rust, the tooling support for Rust is already years ahead. It has an integrated test and benchmark runner, a linter, a code formatter, syntax highlighting in every text editor, not to mention that the language itself has many features that makes writing Rust code both more ergonomic and easier to get right than the same in Solidity. Additionally, Rust data structures are very compact

- Slashing:

- Both CSPR and Cardano do not impose any fine for maliciously nodes.

- CSPR implements jail time.

- Enterprise adoption:

- Although the initial Ouroboros paper by Aggelos Kiayias proposed both a public and private blockchain, the Cardano team have chosen to focused solely on the public side chain.

- The Casper enterprise adoption strategy is one of the strongest in the market at present where the team have not boxed themselves into a niche business but instead have a wide ranging enterprise strategy targeting all potential markets. This is in addition to the public side chain.

- The focus from Cardano on the public chain was previously very specific with regard to financial transactions, however recently there has been a push into adoption within Africa.

- Future Proof:

- The design and engineering of CSPR ensures it is a fully future proof blockchain. It has achieved this by ensuring all components (Execution Engine, Network Engine, Consensus Layer) are pluggable. This allowed the blockchain to be upgraded with relative ease.

- Cardano has implemented a segregation between the CSL and CCL layers to enable soft forks of the consensus protocol, however is limited in large changes to the protocol.

Summary

The differences between the two security protocols are less distinct that when comparing some other layer1 chains against Casper. Cardano has moved through a phased of BFT PoS and is now open for decentralization via the launch of the Shelly era. Both projects are also offering a promising of a layer 2 increase in throughput. This is however where the similarities stop.

Cardano evolution has been at a glacial pace, taking many years of research and development to launch a decentralized PoS blockchain with smart contract capabilities. This lengthy period of time may have been fine in years past, however with an increasingly crowded layer 1 project space, competition will results in an increase to the speed of innovation, and its clear that Cardano is at a huge risk of falling behind the pack. With regard to Casper, It is specifically in anticipation of this pace of change, that the CasperLabs team have engineered the Casper blockchain to be fully pluggable and upgradable (including the Execution Engine, Network Engine and Consensus Layer). For Cardano, a split has been implemented between the CSL (Settlement Layer) and CCL (Computation Layer) in anticipation for future soft forks, however this implementation has exposed the network to risks of censorship.

The aggressive marketing tactics of the Cardano community, targeting strategically short and punchy social media and YouTube posts has driven up the number of active wallet addresses and therefore price of the token. The valuation of the token however (#4 in market cap), greatly exceeds any utility currently being gained from the blockchain, as there is no notable projects developing on the blockchain. Its therefore the case, we believe, that the valuation is not simply based upon future potential, but more artificially raised by targeting new users who may not be fully aware of tech and abilities of competitors in this space. The fact that shorter more snappy clips are encouraged for promotion, leads us to believe that the group is focusing on onboarding new users off the back of the recent craze in crypto assets and the Bitcoin bull run, as opposed to a more seasoned, knowable investor. This level of hype is unsustainable in our opinion.

With regard to the smart contract development on both blockchain, the use of a bespoke language for Cardano will likely mean a handful of developers will initially have the knowledge and ability to build. This is in comparison to Rust on Casper where we see sizably more potential for scalability and usability which will accelerate adoption and ecosystem growth.

Focusing on the adoption side, Cardano’s aspirations within the Africa region has been heavily publicised for a long time however the only partnerships we can see to date linked with entities such as schools within the region. There is yet to be an announcement on a multinational level. This is in comparison with Casper, where within its short existence, we have seen exciting news with companies such as iPwe and also sovereign nations such as those publicised with the UAE. We believe this highlights the proactive approach CasperLabs is taking to begin quickly delivering utility from the Casper blockchain.

Both protocols offer a good consensus layer, with Casper CBC being one of the most secure BFT protocols in the market. Cardanos BFT implementation was advertised as being a quick and simple implementation (likely due to the complexity involved in implementing a full solution) until they moved to Genesis Ouroboros where the leader selection process is used in conjunction with the new chain selection rule. We are especially impressed with the pace that the CasperLabs team have pushed a working CBC solution to market.

Due to the overhyping of the Cardano project, we believe that newer layer 1 chains will eventually eat into their market share, thus giving Casper better longer term price potential. In the shorter term, with the Casper market cap being sizeable smaller than Cardano, we believe there is a lot of near term relative value potential in Casper also.

This article is amazing,

it’s deep to technology but simple to understand, will move my cspr to your validator, thank you.