Blockchains For Enterprise

In this article, I shall focus on some use cases for enterprise blockchains, when it is suited and why we think CSPR has strong future in within this sector. Recalling from our previous article covering Crypto Past, Present and Future, we discussed how the crypto market has evolved, some factors driving the current price action and also where we think it is headed. We commented on Bitcoin gained dominance through its first mover advantage, embedding itself as the leading store of value/ inflation hedge coin and how Ethereum has done the same within the smart contract sector. We noted that both coins do not have the leading tech however due to both being first movers, they have established cult followings driving the coins price through the networking affects of crypto (Metcalfe’s law which is touched upon here). We then concluded the article with the open question on where crypto is headed next and argued that the enterprise solutions space is likely where we will see the biggest growth in the coming years. Its because of this, we looking to provide some clarity and further agreements around the case for enterprise.

Investing in enterprise blockchain will likely become simply for competitive reasons. Just as corporations sought a competitive advantages over their rivals through the 70s and 80s and the mid-90s boom in the World Wide Web, knowing their competitors were taking advantage of these innovations, many experts believe blockchain will command the same attention.

Enterprise blockchain technology helps to achieve coherent, effective and secure ways of doing business. To appreciate the role of blockchain, think of the mess that is transactions in business today. Modern business is a world of siloed repositories for data. Each organization keeps a separate copy of their data because there is no collective trust. Not only does this place companies at a data security risk, it duplication is severely wasteful.

Considerations

We are already aware of how distributed ledger technologies provides a secure, shared platform for decentralised applications (DAPPs) and data thanks to its cryptographically secure, auditable and immutable characteristics. They enable mutually mistrusting entities to exchange financial value and interact without relying on a trusted third party while offering a transparent and integrity protected data storage.

However for it to be suitable for enterprise use, we must consider the following characteristics:

- Privacy – In a public blockchain anyone can verify the state of the system. In a centralized system however, different observers may have different views of the state and as such may not be able to verify that all state transitions were verified correctly. Therefore observers will need trust in the central authority authority to provide them with the correct state.

- Transparency – The amount of information which is transparent to an observer on an enterprise blockchain can differ, based upon the role of the observer and permissioning. i.e. not every participant will need to see all the transactions.

- Permissionless – Companies have direct control over them. For instance, they can block transactions that do not comply with their rules, or if law enforcement asks them to do so.

- Integrity – On a public blockchain anyone can verify the integrity of the data and with increased decentralization it becomes increasingly more difficult to tamper with the integrity. However for a centralized system, integrity can only be assured if the system is not compromised.

- Accountability – Each node in the network, which each holds a copy of the transaction history, is known and can be held accountable for its actions. For example, often enterprise blockchains are shared by a few companies or financial entities in a cooperative format.

- Mutable – If all entities managing the network agree, the data can be changed.

- Scalability – Because enterprise blockchains are typically not as decentralized as Bitcoin, they can easily support more transactions at the base layer.

- Trust Anchor – A concept important for permissioned systems where a role is given with highest authority in a system to grant or revoke read/write permissions.

The permissioned aspect of ledgers for enterprise is the key difference from public ones like the one Bitcoin. The reason for this is that public blockchains exist outside the control of any one company or government and are resistant to censorship. This is the reason why it is very difficult for authorities to crack down upon them. In permissioned blockchains companies have direct control over the chain. For instance, they can block transactions that do not comply with their rules, or if law enforcement asks them to do so.

We can consider this further by assigning roles to a blockchain:

- Writer – A participant that is involved in the consensus protocol and helps growing the blockchain (eg a validator).

- Reader – A participant that is not extending the blockchain, but participating in either the transaction creation process, simply reading and analysing or auditing the blockchain.

For a permissionless blockchain, a reader or writer can join or leave at anytime. More importantly there is no central authority restricting or controlling this, or who can ban illegitimate participants. Additionally all written content is readable by all peers in the network.

On the contrary for permissioned blockchains, there is a limited authorized set of readers and writers

There are two types of permissioned blockchains:

- Private – A central party determines the rules of the network and can change them at will. This central party determines who can contribute to the network by, for example, validating new transactions. JPMorgan’s jpmcoin falls into this category.

- Consortium – A group of two or more parties jointly define the network rules, and each entity can contribute to the network. The Facebook-backed libra (now diem) currency falls into this category.

When do blockchains make sense

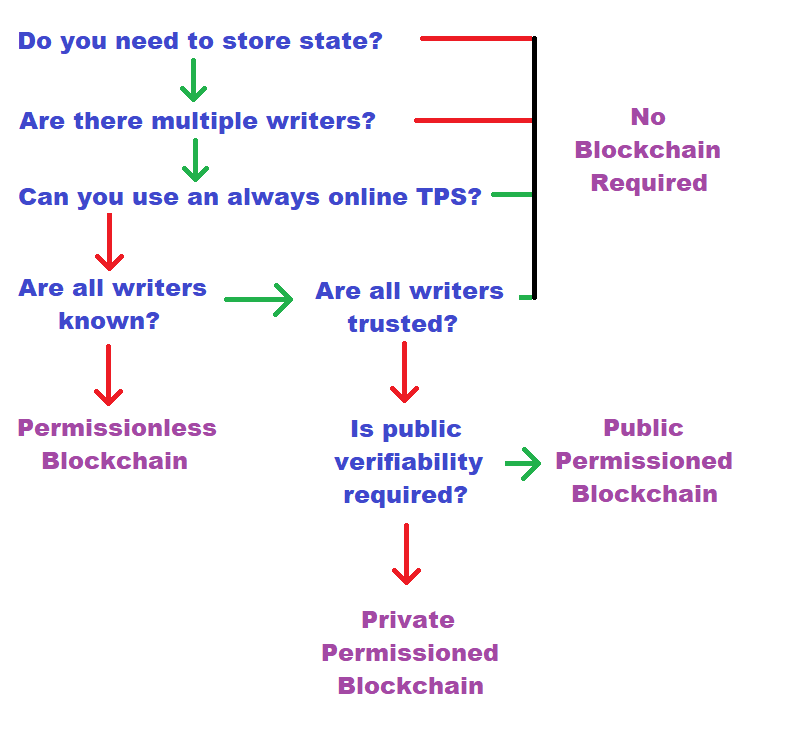

Lets now consider where the use of blockchains make sense. We have already learn from the crypto bubble in 2017 (discussed here) that there are many cases of projects being launched within the crypto space which look to solve a problem or create functionality which is not suited for blockchain. These projects inevitably lose value and interest as their inherent utility values are very low (i.e. have a negative drift component where prices are only sustained with hype, discussed here). There are a series of simple questions which can direct us to the understanding of IF, or WHICH implementation of a blockchain is applicable for a given problem (source).

- Does data need to be stored?

- If no data needs to be stored, then there is no requirement for a ledger

- How many writers are required?

- If there is only a single writer, then a blockchain does not provide additional guarantees and a stand alone database would be a better solution

- Is there a trusted third party?

- If there exists a trusted 3rd party who is always online – it can function as the state verifier with write permissions.

- Are all the writers known?

- This can direct us to then whether a set of known writers are trusted

- Do the writers all trust each other?

- If all writer trust each other and there is no risk of malicious behaviour, a database with shared write access is the likely best solution

Real World Examples

We shall now consider some real world examples of where various blockchain technologies are being used to improve processes or solve for problems within business:

Interbank and international payments– Something as simple as an international payment between two accounts in the current banking system can in fact involve multiple entities. For example you will need 3 banks: (1) bank of the sender, (2) bank of the receiver (3) commercial bank in receivers country to accept the foreign payment. In addition there will also likely be a entity representing the nostro account. The drawbacks are therefore the long transaction confirmation time, the cost related to the multiple intermediators and the trust that is required between the banks.

In the above example the banks will act as writers. If we only consider single currency systems, we do have a trusted third party, i.e. the central bank. The central bank may, however, not want to act as a verifier for every transaction and may only act as a certificate authority giving out licenses to banks to participate in the system. This means that all writers of the system are known and we can use a permissioned blockchain. Whether the chain should be publicly verifiable is a matter of opinion, i.e. the blockchain can either be public or private. On one hand, banks likely want to keep their monetary flows private, on the other hand, having public verifiability may increase the trust of the public in the monetary system.

Contrary to the traditional system, the payment is atomic, i.e., either all of the intermediate payments go through or none of them. In the traditional system, if something goes wrong for an intermediate payment, previous payments have to be reversed and sometimes manual intervention is required.

in terms of live examples to-date we can look into the case of the Monetary Authority of Singapore (MAS), who have worked on non-cross currency interbank payments. When funds are deposited into the bank, an equivalent amount is added to the distributed ledge and can be instantly transferred.

With regard to cross-currency payments, both VISA and SWIFT are currently in the proof-of-concept stages in development of blockchain technologies to solve these problems.

Supply chain management – Due to the fact that typically within a given supply chain, multiple companies interact and trade on a global scale, there exists additional costs related to this complexity. These are related to (1) inventory management, (2) processes (3) failure detection etc. The introduction of blockchain solutions to this sector has lead to the concept of demand instead of supply chains (Demand Chain Management), where businesses will benefit from a greater flexibility in interacting with different markets. Companies like Walmart are proactively advertising these types of solutions:

Demand Chain Management (DCM) – This focuses the customers interests are at the core of the chain. All stakeholders have a real time visibility of what consumers want and are purchasing. Contrary to SCM, which “optimizes the flow” and might be based on incomplete and inaccurate market assessments, DCM requires companies to have a complete and accurate view of the market to proactively choose optimal production decisions.

There are projects at present which are looking to shift towards a demand chain. Walmart has partnered with IBM to implement blockchain for food traceability in its supply chain. Additionally there are projects which claim to make it easy and safe for manufacturers to share product data with vendors and consumers throughout the lifecycle of the product. This “360-degree view” of the supply chain both informs the parties responsible for bringing the product to market and guarantees that consumers are receiving what they paid for. At present however as this is still a very new field of work and research, there is no fully productionised demand chain linked to blockchain.

Equity share listing – As a general rule, any company whose capital is based on registered shares must keep a share register. Such a register provides the necessary transparency and proof of ownership of the company’s shares. It is imperative that this register be protected against manipulation or loss of data. Traditionally, a register is kept in a classic database.

Ten31 bank, the fintech division of WEG Bank AG has tokenized some equity by issuing new shares as ‘Blockchain Listed Shares’, which the German regulator (BaFin) has approved. With “Blockchain Listed Shares”, all actions that record or require the ownership and transfer of shares can be carried out fully digitally.

Land Titles – In particular in countries where corruption might dominate and the integrity of official documents could be questionable, the use of blockchain could potentially help to provide more transparency through public verifiability. As such, several projects have started to secure land titles on a blockchain.

The idea is interesting, but similar to supply chain management ie the physical world needs to be connected to the digital, as the actual rights to a property eventually need to be enforced by some authority, i.e. there exists a party that is trusted for enforcement.

The obvious question is therefore why doesn’t the trusted party simply publish the register of land titles? which is in principle the current practice today in most jurisdictions. The reason for the use of a public ledger is that it could ensure that an authority – that is not necessarily trusted for anything other than enforcement – could not change land ownership in an undetected manner. Additionally, having land titles on a blockchain that also offers a method of payments would enable smart contracts to sell and buy property.

Healthcare – Blockchain security, privacy, data integrity and anonymity could enable new uses of individuals’ genomic data and medical records to support pharmaceutical research and make it easier to transmit electronic medical records.

Logistics – A blockchain freight-invoicing application deployed by Walmart Canada uses smart contracts to pull live shipment data into invoices and send preapproved payments once the terms of the shipping agreement are met. This is an example of how a well-designed blockchain application can save significant time and money by minimizing data reconciliation processes and disputes.

Current Market

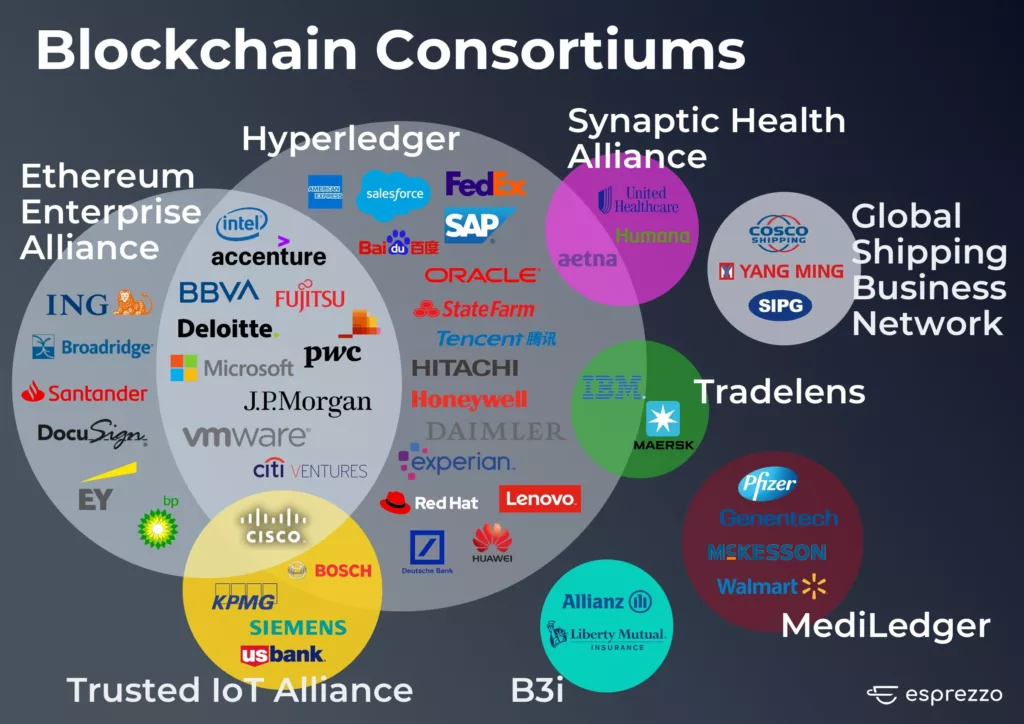

According to Deloitte’s 2018 Global Blockchain Survey, 29% of businesses polled stated that they’ve already joined a blockchain consortium, 45% stated they are likely to join one within the next year and 13% say they’re interested in starting a consortium of their own. In many cases, consortium members are fierce competitors. For example, Bank of America, Citi, Barclays, Morgan Stanley and other multinational banking institutions are members of the R3 consortium.

So what’s the motivation for these competing business to work together? The benefits of working together to better understand and improve blockchain technology are just too great. By working at the consortia level, these businesses share costs, create unified industry standards and expedite innovation by leveraging scale.

Lets consider some existing projects. We shall consider both crypto start-ups and existing cooperation’s:

Facebooks LIbra: which will let you buy things or send money to people with nearly zero fees. You’ll pseudonymously buy or cash out your Libra online or at local exchange points like grocery stores. Unlike many other blockchains, Libra seems laser-focused on payments and other financial use cases for consumers.

Initially, the consensus structure for Libra will be dozens of organizations that will run nodes on the network, validating transactions. Each time consensus is voted on for a new set of transactions, a leader will be designated at random to count up the votes. This means the blockchain will be fully permissioned. Libra opts to rely on familiarity rather than democracy to choose the right entities to establish consensus in the early days. “Founding Members are organizations with established reputations, making it unlikely that they would act maliciously,” the white paper states.

R3 (Corda): Issued by start-up LAB557 (founded by former RBS bankers). Backed by many of the worlds largest banks. A permissioned blockchain, with a focus on legally enforceable financial transactions. The transaction is shared only within the sub-network or flow. In that sense, there’s a direct communication instead of a global broadcast, and privacy is preserved. Transactions are not put into blocks but instead sent directly to the involved parties.

Corda has transmitted the responsibilities of knowing the world state and seeing all transactions from the entire network onto a special notary service. Members of the network don’t need to trust everyone, just the organizations that run the notary. There can also be multiple notaries, each trusted for a different purpose.

Ethereum Enterprise: The ETH code base is used by enterprises to for business blockchain networks. These are private and permissioned instances which are separate from the the public chain but have the option to bridge data to the public blockchain.

For the record, there is no single product called “Enterprise Ethereum.” We use the term here to refer holistically to blockchains built using modified Ethereum clients, such as ConsenSys Quorum,

They can transact much faster than the 15–20 TPS reported on public Ethereum because network size is smaller, and gas limits and block sizes can be adjusted to allow more transactions per block, scaling to as many transactions per second as other enterprise solutions and DLTs

Hyperledger Fabric: Created by the Linux Foundation. It is not a blockchain or cryptocurrency. It is a software used to create a personalised blockchain service. It can be considered like any other project under the Linux Foundation such as node.js. On the hyperledger network, only parties directly related to the transaction deal are update on the ledger, thus maintaining privacy. This is achieved using channels – a virtual blockchain network which sits upon a physical blockchain network.

Messages are sent to the node.js backend, the sdk client takes this proposal and sends to all the endorsing peers of the the organisation (as per a endorsing policy in the channel config), this includes a proposal to invoke the corresponding function on the chain code. The message get verified and committed to the CouchDB, thus confirming the transaction.

How CSPR Fits In.

From the above article, we have shown (1) when blockchains should be used for business, (2) how hey should be structured, (3) the demand for enterprise blockchains and some (4) competitors. We shall now discuss why we feel CSPR is the best suited solution, with the following points:

- CSPR is a full layer 1 blockchain unlike the competitors mentioned above. This means that it will serve as its own public and permissioned blockchain. This is unlike enterprise ETH blockchains which are effectively clones and modifications of the ETH codebase.

- CSPR has the option to switch from permissioned to public, unlike Libra, R3 and Hyerledger.

- The CSPR layer 1 blockchains is currently POS. This means that if enterprises want the optionality to switch from public to permissioned, the public side will be the best tech. Unlike enterprise ETH where the switch to public will be onto a POW blockchain with 15-20TPS.

- The CSPR layer 1 blockchains driving feature is the consensus and highway protocol as described here and here. This will lead to increased interest of dapps being developed on the public blockchain which potentially could be communicate with the permissioned chain (with authentication in place)

- CSPR is not focused on one business sector, such as Facebook with payments or R3 with banking.

- CSPR gas futures market concept. By tokenizing block space to allow companies to buy future block space, Casper’s gas model aims to allow its blockchain’s users to lock in prices now, to have more predictable future network usage costs. Medha Palika (CTO CasperLabs): “Enterprises do budgeting at about every half a year, so about six months….[By] providing enterprises a six-month window, they’re going to have a pretty good sense of what their network usage is going to look like.”

Above are merely a few key points on why CSPR is by far the best positioned blockchain to dominate the enterprise sector. We can see that CSPR not only holds all the characteristics of the current enterprise blockchain solutions, but also benefits from having the strongest consensus protocol within its public chain. Where it is becoming increasingly apparent that the blockchain enterprise sector will be the next big evolution of the crypto market.

Disclaimer: This article is written for the purposes of research and does not constitute financial advice or a recommendation to buy.