Crypto – Past, Present, Future

Past

Crypto has evolved to-date in a similar fashion to how internet stocks did previously. Internet stocks during the dotcom bubble saw valuations driven by the expectation that a new technology would result in the generation of wealth. Also as with the rise of internet stocks there was (and is) value assigned to the global interconnectivity of individuals via the web, as never seen previously in humanity. The frenzied speculation in the dotcom bubble, assigning values to companies with zero revenue, led to the inevitable bust. This was similar to the crypto craze seen in late 2017 where projects launched creating tokens which really had no benefit in being tokenized (i.e. there was no inherent utility to the coins). Examples of these being coins issued by celebrities and coins linked to legitimate businesses but with no real need for tokenization. However, there did exist the same expectation that this new blockchain technology would drive wealth creation and revenues, as with the dotcom bubble. Read more here.

Fast forward to today and what we see is some of those same coins with no inherent value in 2017 are now being named ‘meme coins’ and holding value purely from a cult status. We also now understand and see differing behaviour with the coins that hold real utility value: those being actively traded for longer, having more inherent support to the prices. This makes sense as we would expect owners of Bitcoin and Ethereum to have bought into the coin at various different times and levels over the history of trading, with some owners being in profit, and some at a loss. Also the propensity to unwind or enter will also be a function of this and so we see differing behaviours among current owners and new entrants. This is the reason, that in the current dip, we are seeing more exaggerated price decreases in the coins issued in 2021 (eg ICP, Mina and CSPR) as these do not have the same degree of support built into the price over years of trading. We can characterise this phenomena by classifying coins into various categories (more on this here):

- High volatility, negative drift: These are typically the highly speculative meme coins which exhibit large pumps and dumps with no real long term value or utility. Speculating in these tokens can be highly rewarding due to the volatility but the negative drift implies they are not suitable for long term holding. Additionally there exists sizable risks of being wiped due to the negative drift, where holding will not recover losses if a trade is poorly timed.

- Newly issued tokens with strong fundamentals: These will exhibit a high long-term drift component but will also begin life with very highly skewed volatility dependent on the regime which Bitcoin is following at the time of issuance.

- Established tokens with strong fundamentals: These will have typically less potential for exaggerated price rises in comparison with more newly issued tokens however will also experience less volatility due to support levels being built into the price from historical trading. The skew on these tokens will also be less and more directly correlated with Bitcoin (for now).

The major difference in the market today, when compared to 2017 is the influx of institutional money. This is likely due to research and modelling around Bitcoin and Ethereum, suggesting huge future value potential.

Longer term, we see Bitcoin following the S2F (Stock-To-Flow) model. The S2F model is used to measure the scarcity of a resource by dividing the available inventory of a resource over the amount mined in a given year. For resources which are not consumed (such as gold and Bitcoin), this ratio increases over time. This, coupled with the networking effects (Metcalfe’s law which helps explain why ETH is also following the S2F model despite its unlimited supply) all point to a substantial future growth in value of the crypto market. With this expected phenomenal increase in prices for the incumbent (Bitcoin) and first to market smart contract blockchain (Ethereum), you will then also see a rise in value of other successful blockchains. Read more here.

Supporting the macro shift is also the apparent change in the view of global regulators, where we are seeing a notable shift in the narrative of regulators in both India and the US. Where the narrative has shifted from a previous knee-jerk reaction to the growing dominance of an asset which cannot be controlled with monetary policy, to one where there is a genuine understanding of the benefits of blockchain technologies. There is however an increased focus on stable coins with Janet Yellen (US Treasury) who stated that there needs to be a greater oversight of this sector.

This is of course in contrast with the view of China, where a hard-line crackdown on mining activities has seen a Bitcoin hash rate and complexity fall. Considering the propensity for miners to keep rigs active is a function of both the Bitcoin price and complexity, this reduction in hash rate has hastened the move to set up operations in other parts of the world.

Both the change in stance of regulators and the influx of institutional funds has led to a structural shift in the crypto market. Whereas before it was being driven by pure speculation, we now see price drops as an opportunity for entry for some of the larger institutions. One such player being Guggenheim: a giant on wall-street. Guggenheim predicted a 400k Bitcoin value in late 2020, and at the time also filed for SEC approval to trade spot. Since then, as we know, the price of Bitcoin soared prior to the approval being finalised which meant the investor missed out on this upside. Since then Guggenheim correctly predicted the recent correction of 50%. This prediction was made a day before BTC began its descent. Since this fall we have learnt that Guggenheim have further applied for SEC approval to trade BTC futures, therefore we could expect to see some leverage plays from this investor in the near term.

A further development to the market is soon to be introduced CDBC’s (Central Bank Digital Currencies). This we feel has potential to shock global markets outside of purely the crypto asset class. A recent report highlighted the potential for control which central banks could have on spending via the issuance of CBDC’s. The IMF has highlighted things such as the ability of central banks to apply a FX rate between the CDBC and cash, thus forcing a move from the cash markets into digital currencies. This would result in an increase in tax revenues, squeezing shut current undeclared cash transactions. Additionally, being able to control a currency to the degree possible with a CDBC means that governments can force spending on targeted individuals. For example if you are a higher rate earner, there will be an ability to enforce a ‘spend-or-tax’ policy whereby if a percentage of income is not spent, it could be exposed to higher taxes. Moving these funds to cash to avoid this will also be impacted from the FX rate as discussed.

Present

Immediate price action in the crypto space is being driven by a few key driving factors:

- Regulator action. We are seeing a crackdown by the New Jersey regulators on the BlockFi interest accounts. For those unaware, BlockFi offer interest on primarily Bitcoin and Ether portfolios (paid out in the deposited coin or stable coin). BlockFi generates interest by lending out deposited coins to institutions and corporate borrowers. Regulators in this state have issued a cease-and-desist order which prevents BlockFi from opening any new interest accounts. The reason being that they believe the interest account must be treated as a security and therefore fall under the same strict regulations as any other security. As BlockFi is a large share holder of the GreyScale trust, if there is a run on accounts due to this news, where depositors were to withdraw funds, this would mean that BlockFi would have to sell GreyScale shares and use those funds to buy back spot Bitcoin. However we know that the GS shares are now trading at at discount to spot BTC. This would mean that BlockFi will likely face liquidity issues. One to watch.

- GreyScale unlock. GreyScale shares with an underlying Bitcoin totalling around 40,000 Bitcoins are being unlocked this week. Previously there existed a carry trade which incentivised purchasing of these shares when the shares were trading at a premium to spot Bitcoin. This no longer exists.

Speculation is that it is likely that investors who borrowed Bitcoin to purchase GreyScale shares, will now need to buy Bitcoin from the spot market in order to repay those loans and unwind their positions.

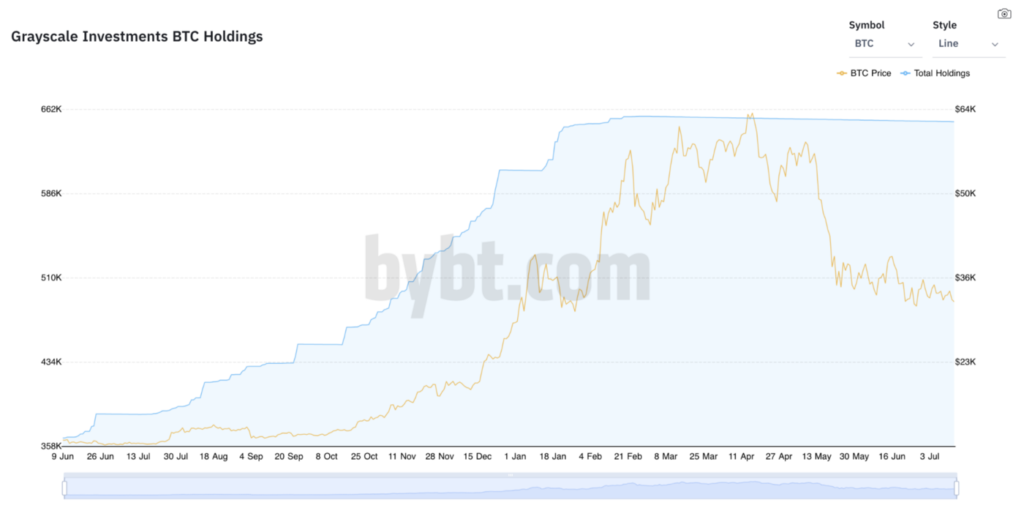

There is also however a lot of commentary in circulation speculating that the unlock could be seen as a negative to the market in general. One interesting thing to note is that as the GreyScale fund deposits maxed out earlier this year, this correlated with an increase in interest with the Canadian ETF, potentially indicating that we might see a permanent maxing out in the funds value (see figure. 1 below). This also is leading GreyScale to explore opening their own ETF. - Bond Yields / Equity Markets. We are seeing a big squeeze on the 10-year US treasury bond yields as investors are beginning to see the future economy as more bleak than previously thought. The bounce back from Covid doesn’t feel so bouncy now. This is likely a driving factor in the Bitcoin downtrend as we can consider Bitcoin as being a true free market. Unlike Equities, which often has intervention via the FED and policy maker, Bitcoin is free to react in a similar way to bonds (with a stable base rate). With rates low, and inflation likely to kick-in, what we will see is in fact negative real rates on bonds. This would affect many in retirement, whose pensions are based on income-generating bonds. Will the authorities intervene? Our view is likely. With additional possible printing, this could be a boost for Bitcoin. When is this likely to happen? ….unknown as yet.

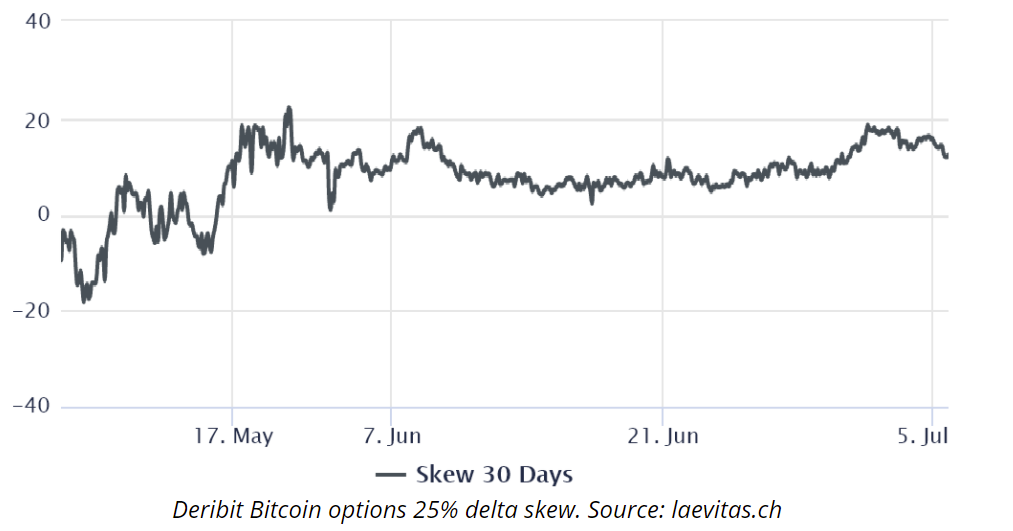

- Options activity. The difference between premiums paid for CALL and PUT options on Bitcoin has skewed such that the PUT is now relatively more expensive when compared to the CALL (see figure. 2 below). Note however, that even though this indicates more demand for the PUT (i.e. prices expected to go down), the CALL premium actually peaked at the peak of Bitcoin pricing, meaning that the options market at that time was incorrect in predicting Bitcoin future prices. Also to note, there is an increase in the number of short strangle option strategies being traded. This strategy pays out if Bitcoin does not break in either direction, i.e. continues in trading flat.

Future

We feel that ETH, even with its technology limitations (currently POW with the aim to slowly evolve to POS over many years), will hold a substantial share of the smart contract market outside of the enterprise space. This purely arising from the cult-like status it holds and also the first to market advantage. Future long term expected values are covered here. This is the same advantage seen by Bitcoin being considered the dominant store of value. The race is then on for the leading enterprise blockchain – there will be a degree of first to market with this also, but we believe you will see blockchains succeed which are proactively taking steps to accommodate for the needs of enterprises. These needs will inherently be linked to the concerns and focus of regulators. The main focus being the crackdown on illicit activities and the use of crypto to bypass more traditional banking Anti-Money Laundering (AML) controls. With this in consideration, we feel there are some crypto assets which will be more susceptible to increased regulation – namely Bitcoin. This is due to the primary purpose of Bitcoin being a store of value without any real world utility. Infrastructure projects such as ETH and CSPR have more real world utility and are used to facilitate development of applications on their respective blockchains and can be considered more as a technology solution than merely a speculative asset. Intrinsic value of these tokens will eventually become a function of the demand for processing transactions on the blockchains as opposed to being driven by the current speculative nature which is dominant within the crypto space. Further to this, we are also encouraged by the active efforts taken by the CSPR team, in partnering with teams such as AMLSafe, to offer wallets with in-built compliance support. This additional control on KYC, will not only appease future regulation, but will also encourage enterprise adoption of the blockchain (as these adopting companies will also be impacted by the upcoming regulatory changes).

Disclaimer: This article is written for the purposes of research and does not constitute financial advice or a recommendation to buy.